As ASEAN’s digital economy grows rapidly, an increasing number of fintechs—from across Asia and other international markets—are moving to tap into its potential. But for those entering the market, it’s critical to recognise that the region’s fintech ecosystem is evolving swiftly, and that winning in this increasingly sophisticated market will require more than product innovation alone.

Foundational infrastructure decisions—around compute, connectivity, and compliance—are emerging as core determinants of success. Though often invisible to end users, these capabilities are increasingly visible in business outcomes: Speed, trust, uptime, and the ability to scale AI securely and cost-effectively. Together, they could help determine which fintechs unlock ASEAN’s full potential—and which fail to gain traction.

Fintech's Momentum Is Real—But Pressure Points Are Emerging

The past few years have seen Asia Pacific emerge as one of the world’s most dynamic fintech markets. By the end of this year, the region is projected to capture 47% of the global fintech market, reaching a value of US$1.9 trillion (total transaction volumes), according to IBS Intelligence. This pace of growth is drawing interest from both regional players and global fintechs looking to enter and expand.

At the same time, pressure is mounting across multiple fronts—a reality new entrants must address.

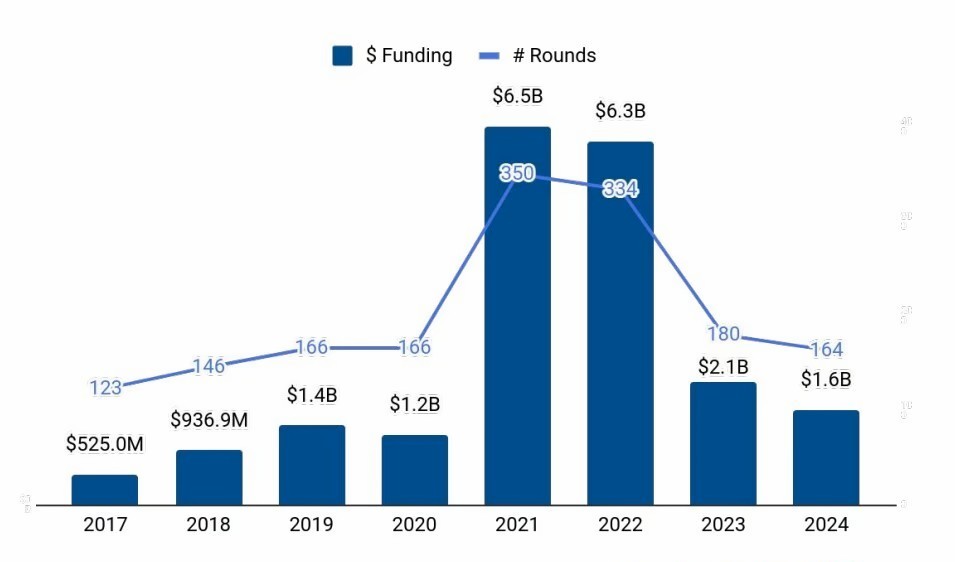

Funding has slowed significantly, forcing fintechs to shift focus from growth at all costs to profitability and capital efficiency. Southeast Asia’s fintech sector recorded a 23% drop in funding in 2024, compared to 2023—coming on the back of a 75% decline between 2022 and 2023, shows data from Tracxn.

Regulatory challenges are intensifying, too. KPMG’s Exploring the Fintech Frontier report reveals that 46% of Asian fintech leaders cited increased regulatory scrutiny from both regulators and strategic partners as a major trend shaping the future of the sector. Meanwhile, customer expectations continue to rise, particularly around real-time service, personalisation, and trust.

Challenging Times for the Region’s Fintech Sector

|

Funding is Slowing

Source:Tracxn |

Regulations are Tightening 46% Of Asian fintechs expect increased regulatory scrutiny from regulators and business partners

Source:KPMG |

These hurdles aren’t slowing down fintechs in the region, who remain focused on scaling. According to The Future of Fintech in APAC report, market expansion and product/service innovation are the top two strategic priorities for fintech leaders.

However, this momentum is exposing serious stress points in the infrastructure that underpins B2B and B2C fintech service delivery. For example, AI adoption is expanding across fraud detection, credit decision-making, and customer experience use cases—yet many fintechs lack access to the scalable compute needed to support these models. Likewise, real-time services such as cross-border payments and instant settlement depend on ultra-low latency, and high uptime—capabilities that are often constrained by legacy networks or less-than-optimal connectivity choices.

These forces are converging—and placing infrastructure at the centre of strategic discussions.

Compute Power Is the New Currency—Are You Spending It Right?

AI is an active force shaping customer experiences, operational decisions, and competitive positioning. Recent research shows that 82% of fintechs view AI and machine learning as critical to achieving short-term business goals. However, realising the promise of AI requires more than algorithms; it demands reliable access to high-performance core and edge compute infrastructure, specifically GPU environments optimised for training and inference.

Fintechs looking to capitalise on the ASEAN opportunity face choices—and critical constraints—in accessing this infrastructure. Most public cloud platforms, for example, offer limited control over the physical location of this infrastructure, resulting in non-compliance with regional data localisation mandates. On the other hand, building in-house GPU clusters is capital-intensive and operationally complex. For fintechs, the challenge is clear: How do they scale AI within regulatory boundaries, while maintaining cost-efficiency and performance?

Emerging models such as GPU-as-a-Service—offered by TM Global through sovereign, LEED-certified data centres—provide a strategic alternative. TM Global’s infrastructure offers elastic GPU capacity with low-latency edge delivery, compliance with data sovereignty regulations, and flexible charging models—enabling fintechs to pursue AI strategies without compromising cost, control, or compliance.

Connectivity is a Catalyst for Fintech Success

Responsiveness is fundamental to fintech operations everywhere—but it’s especially critical in ASEAN, where widespread digital adoption has led to higher customer expectations. Whether enabling instant payments, powering algorithmic trading platforms, or supporting real-time LendTech decisions, low-latency, and highly reliable connectivity is no longer optional—it’s foundational to service delivery, customer trust, and growth in market share.

As fintechs offer more cross-border services and embed themselves deeper into financial ecosystems, the demand for high-performance connectivity and networking is only intensifying. Cross-border payments and FX settlement require low latency and intelligent routing. Wealth Tech firms rely on high-throughput connectivity to aggregate market data and deliver personalised investment recommendations. Fintech platforms delivering embedded finance solutions increasingly depend on direct peering to reduce network hops and accelerate API exchanges with banks, payment gateways, and other critical players in the financial services ecosystem.

Meeting these expectations requires connectivity and networking infrastructure designed for speed, reliability and agility. Future-focused fintechs will increasingly turn to dedicated network architectures that combine SD-WAN with its intelligent path optimisation, direct peering with TM IP Transit Internet exchanges, and high-capacity backhaul that connects national fibre networks to core data centre and international subsea routes.

TM Global’s connectivity and network solutions—anchored by Malaysia’s widest fibre footprint, direct peering with 120+ ISPs, strategically placed edge nodes, data solution offerings, and international subsea connectivity—deliver performance, dynamic failover, and regulatory compliance; capabilities that are essential for fintechs entering the ASEAN market to compete effectively.

Compliant Infrastructure is a Strategic Enabler

Infrastructure decisions are now being shaped as much by regulators as by architects. In markets like Malaysia, Singapore, and Indonesia, compliance mandates increasingly govern not just where data is stored—but how infrastructure is operated and secured. Regulatory expectations now extend to operational resilience, third-party dependencies, and environmental sustainability—creating additional layers of accountability for fintechs.

Fintechs today are not just seeking compliance—they're seeking confidence.

TM Global delivers that confidence with infrastructure engineered for regulatory alignment, supporting fintechs in meeting the full spectrum of requirements across data sovereignty, operational resilience, industry regulations, and environmental mandates. Its facilities are Tier III-certified by the Uptime Institute and hold accreditations including ISO/IEC 27001 (information security), ISO 22301 (business continuity), and PCI DSS. With in-country hosting, and intelligent failover, TM Global enables fintechs to operate confidently—not just in compliance with the law, but in alignment with future regulations.

As regional and global fintechs prepare to expand in ASEAN, they will need to navigate local regulations and meet rising expectations for seamless, hyper-personalised customer experiences. The ability to execute these priorities at scale will depend on an invisible foundation: Digital infrastructure that enables high-performance compute, seamless connectivity, and built-in compliance.

TM Global helps fintechs building a footprint in ASEAN create that foundation—supporting them with sovereign, AI-ready, and regulation-aligned data centre and connectivity infrastructure that’s built to supercharge what comes next.

To learn how TM Global can support your infrastructure strategy, get in touch with us.